Motorists over 65 Once you reach your 60s, things begin to reverse. From that factor forward, vehicle insurance policy premiums progressively raise. It's not so much that older motorists are much more hazardous, yet that their driving is affected by bodily adjustments that include age. It's usual for elderly drivers, for instance, to have blurred vision, specifically at evening.

We stay in a post-Fast and Angry world. There has actually been a surge in the propensity of male motorists to gas the pedal when the light turns yellow. This isn't a sort of bias, but instead a recommendation of the analytical reality that males are most likely than women to speed and also be entailed in significant crashes, particularly when they're young.

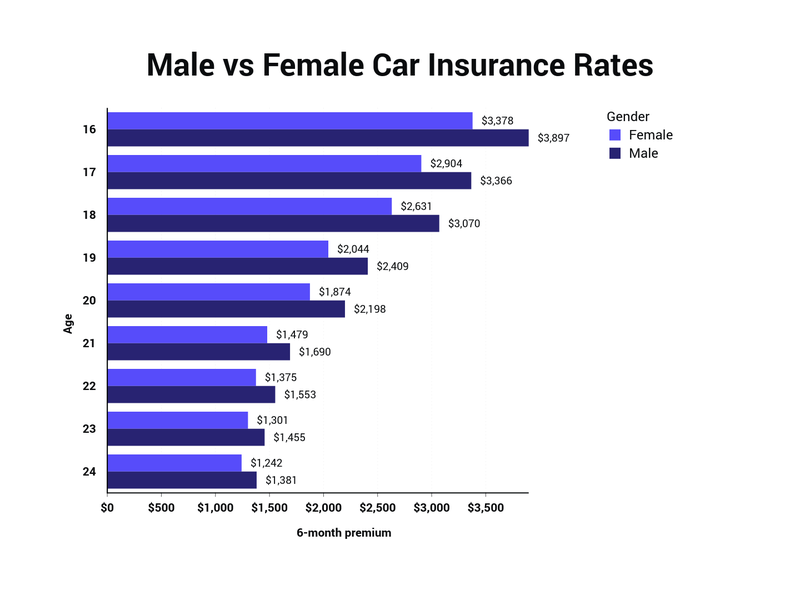

Other than driving conduct, guys are much more most likely to have cars deemed to be risky, such as cars. Nevertheless, also though guys often pay higher prices, this is not always the case. It's most visible among young vehicle drivers between the ages of 16 and 24, where male vehicle drivers pay 15% more than female motorists.

Wedded motorists can pay up to 50% less than solitary drivers. Part of this is due to the fact that wedded chauffeurs are extra cautious behind the wheel than solitary motorists.

Take a look at our blog sites for details on finding, the most effective, and also cost effective. vehicle insurance.

insurance car insurance car insurance vehicle insurance

insurance car insurance car insurance vehicle insurance

In this short article: Generally, younger chauffeurs have a tendency to pay even more for automobile insurancebut as soon as you get to the age of 25, the expense of your insurance plan can go down. According to , the average yearly costs for a 24-year-old male with complete protection is $2,273. At age 25, that average drops to $1,989, a reduction of concerning 12.

The At What Age Does Car Insurance Go Down? Read On To Find Out Diaries

If you intend to wait up until your plan restores, call your insurer to see to it that you'll get a discount rate when it calculates your price for the next plan duration. Ways to Lower Automobile Insurance Policy Costs, While you can not regulate every one of the variables that go into your automobile insurance rateyour day of birth is set in rock, for instancethere are some that you can manage.

Bear in mind, every one will certainly evaluate different variables in a different way, as well as some offer discount rates that others do not. It won't assure a reduced price, yet it might aid. Some auto insurer use optional coverage that's nice to have, yet may not deserve the price. Look for secondary coverage that you don't absolutely require and also might stand to cut.

The majority of insurance companies offer price cuts to consumers who buy numerous policies. You might be able to reduce your car insurance policy by packing it with tenants insurance policy, property owners insurance, life insurance policy, motorcycle insurance policy or various other policy types. Some insurance coverage firms provide a discount rate if you participate in a protective driving training course, either online or in-person.

You'll likewise get real-time signals when changes are made to your credit scores record, such as brand-new accounts and also queries - cheaper car insurance. Checking your credit report carefully will give you the details you require to construct and preserve a excellent credit rating.

Some firms, such as Nationwide and also Progressive, offer more eye-catching discounts when you turn 25, however this is not the standard. Car insurance coverage rates are normally greater for young chauffeurs, so looking around is an excellent concept considering that carriers provide differing rates. It isn't shocking, though, that many people believe 25 is when insurance rates drop.

Although many people believe that 25 is the age when cars and truck insurance policy prices go down, one of the most significant reductions occur when vehicle drivers turn 19 and also 21. Fees continue to lower till you transform 30 afterwards, they often tend to remain approximately the exact same. The only time costs start to boost once more will certainly be when you come to be an elderly chauffeur.

Some Ideas on How Much Is Car Insurance For A 16 Year Old? You Need To Know

According to the National Freeway Web Traffic Safety and security Administration, male drivers are most likely to be associated with fatal accidents due to speeding and also drive vehicles that cost more to guarantee. An FBI record also located male chauffeurs are two times as likely to be arrested for extreme driving infractions like Drunk drivings - liability.

car cheaper auto insurance cheaper car insurance laws

car cheaper auto insurance cheaper car insurance laws

An archetype is driving experience. If two 26-year-old drivers purchase cars and truck insurance policy, with one just having begun driving a month ago while the various other has lagged the wheel because they were 16, you'll see a considerable distinction in their premiums. The former is much less seasoned, and providers will certainly consider them riskier to insure, leading to Learn more here higher cars and truck insurance coverage prices.

Marital Condition, Insurance carriers see wedded vehicle drivers as more solvent and also a lot more likely to drive safely than those that are not, regardless of whether they are single, married or widowed - credit. Married individuals are likewise most likely to put both their autos under a solitary plan, making them eligible for multi-car discounts.

D. results in lower automobile insurance coverage prices - automobile. Work, Automobile insurance policy providers typically consider your chosen career when establishing premiums however might use different reasoning when determining prices.

Credit Scores Background, Research studies have revealed that motorists with poor credit report are most likely to submit claims, leading to extra pricey cars and truck insurance rates. cheap car. Place, Where you live adds to the cost of your costs. Chauffeurs from even more booming locations with higher crime rates tend to spend extra on automobile insurance.

How Drivers Under 25 Can Pay Less for Vehicle Insurance policy, Vehicle insurance policy for a 25-year-old can be costly. Taking these actions can assist young vehicle drivers lower their insurance policy costs and receive even more economical costs.

The 7-Minute Rule for Motor Insurance: Will Car Insurance Go Down At Age 25?

5Take a defensive driving program. You can commonly obtain a discount rate if you finish a protective driving course. Not all service providers use this, so inquire concerning it with your provider ahead of time. FIND OUT MORE CONCERNING CONSERVING ON auto INSURANCEAlthough automobile insurance coverage rates are greater when you're younger, there are useful means to reduce them.

Vehicle insurance costs can be strange at the most effective of times. If you relocate, buy a new cars and truck or just age, rates can rise or down without a lot of explanation. See what you might minimize cars and truck insurance coverage, Conveniently contrast tailored prices to see just how much switching automobile insurance policy can conserve you.

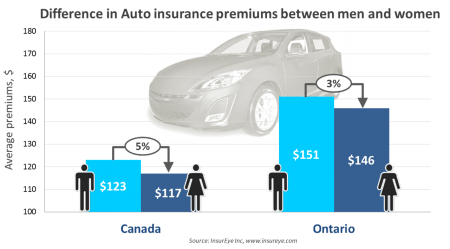

Age as well as sex are two of one of the most common variables that affect your auto insurance rate. As well as while not all states let insurance firms use these factors the exact same means, the majority of enable them to be part of the formula. Vehicle insurance policy rates throughout the nation vary based on where you live, but national standards can offer you a concept of what you may pay.

Full insurance coverage policies add added protection on top of state minimum requirements.

That means policies will certainly differ in coverage based on where you live. The prices listed below reflect nationwide standards for minimum insurance coverage, so real prices can differ commonly by state. As numerous brand-new motorists have uncovered, being young is an easy means to pay even more for automobile insurance policy. There go to least two reasons for that higher rate.

Still, also if your state does not enable companies to base prices on age, you might pay more when you're young. If you have actually been driving for just a year or 2, you're most likely to pay more than someone who has been behind the wheel for a decade.

Examine This Report on 2022 Car Insurance Rates By Age And Gender - Nerdwallet

vehicle insurance car insurance cheaper auto insurance vehicle

vehicle insurance car insurance cheaper auto insurance vehicle

Our evaluation found that beginning at age 20, guys pay higher typical insurance prices. Deadly accident rate per 100 million miles driven, Figures from the IIHS based on evaluation of the United state

For instance, circumstances our study, we found that average rates typical prices 20-year-old male driver man Vehicle driver% higher than for a 20-year-old female driverWomen Once again, this data is based on a nationwide average of the 5 largest auto insurance providers, so vehicle insurance prices in your state might be a lot reduced. vehicle.

You're most likely to see different rates from practically every insurance policy company due to the fact that each of them utilizes the information they have concerning you a little differently (vehicle). Some care more about your driving background, while some care more regarding the cars and truck you drive. Vehicle insurer are also restricted by guidelines for setting vehicle insurance policy rates that vary in each state.

As an example, a 35-year-old chauffeur in Florida is considering an ordinary yearly price of $2,775 for full insurance coverage. Cross the line into Georgia, which same driver obtains an ordinary rate decrease of over $1,000, to $1,698. Therefore, where you live is among the greatest factors in the cost you inevitably pay.

Excitement About Average Car Insurance Rates By Age - Carinsurance.com

Note: In this post, Nerd, Pocketbook makes use of the term "gender." We identify that this is different than sex. Sex is how you determine within culture, while sex describes particular organic qualities. Some insurers do not identify this difference and also utilize the terms reciprocally. This indicates when getting car insurance coverage, they may request your sex, when they truly suggest sex.

For circumstances, a company may desire the "sex" you list on your insurance policy application to match the sex detailed on your vehicle driver's license.

Still, also if your state does not permit companies to base prices on age, you might pay even more when you're young. The majority of states do enable insurance firms to make use of driving experience as an aspect in establishing prices, so automobile insurance coverage for new chauffeurs can be pricey, no matter age. If you've been driving for just a year or two, you're likely to pay more than a person who has been behind the wheel for a decade.

Our evaluation discovered that starting at age 20, guys pay higher average insurance coverage prices. insured car. Deadly accident price per 100 million miles driven, Numbers from the IIHS based on analysis of the United state

The Greatest Guide To The One Time When Being Married May Cost You Less - Cnbc

For instance, circumstances our study, research study found that located rates for a 20-year-old male driver man 14% higher than for a 20-year-old female driverWomen Once again, this information is based on a national standard of the 5 most significant automobile insurers, so vehicle insurance policy rates in your state might be a lot reduced.

You're likely to see different rates from almost every insurer because each of them makes use of the details they have concerning you a little differently. Some care a lot more about your driving history, while some care much more about the automobile you drive. Vehicle insurer are also restricted by regulations for establishing vehicle insurance prices that vary in each state.

A 35-year-old chauffeur in Florida is looking at an average yearly price of $2,775 for full coverage. Cross the line into Georgia, which exact same chauffeur gets an ordinary rate decline of over $1,000, to $1,698. As a result, where you live is one of the most significant consider the rate you ultimately pay.

Some insurance companies do not acknowledge this distinction as well as use the terms reciprocally. This indicates when using for automobile insurance coverage, they might ask for your sex, when they actually mean sex.

A company may want the "sex" you list on your insurance application to match the sex detailed on your vehicle driver's certificate.