Compare quotes from the leading insurance provider. vans. Trick Information Regarding Auto Insurance Deductibles, If you have automobile insurance policy, you will need to pay a car insurance deductible when you file a case for repair services and also injuries. Just how much you spend for your insurance deductible depends upon your vehicle insurance protection and also just how much your auto insurance policy premium is.

The at-fault driver in the mishap is generally needed to pay a vehicle insurance policy deductible. Liability coverage does not need a cars and truck insurance coverage deductible, yet just covers the costs of the other chauffeur, not your very own. Regarding the Author.

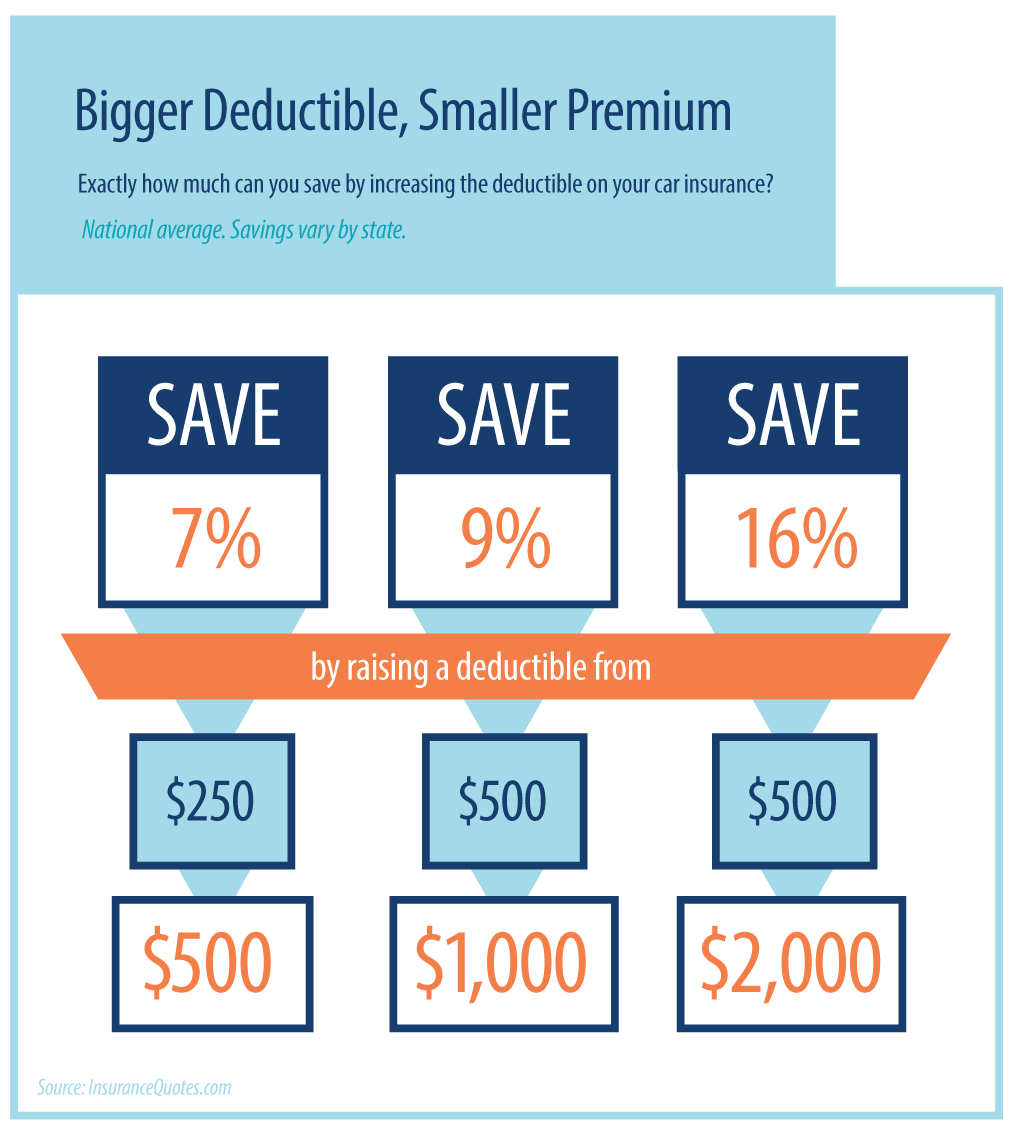

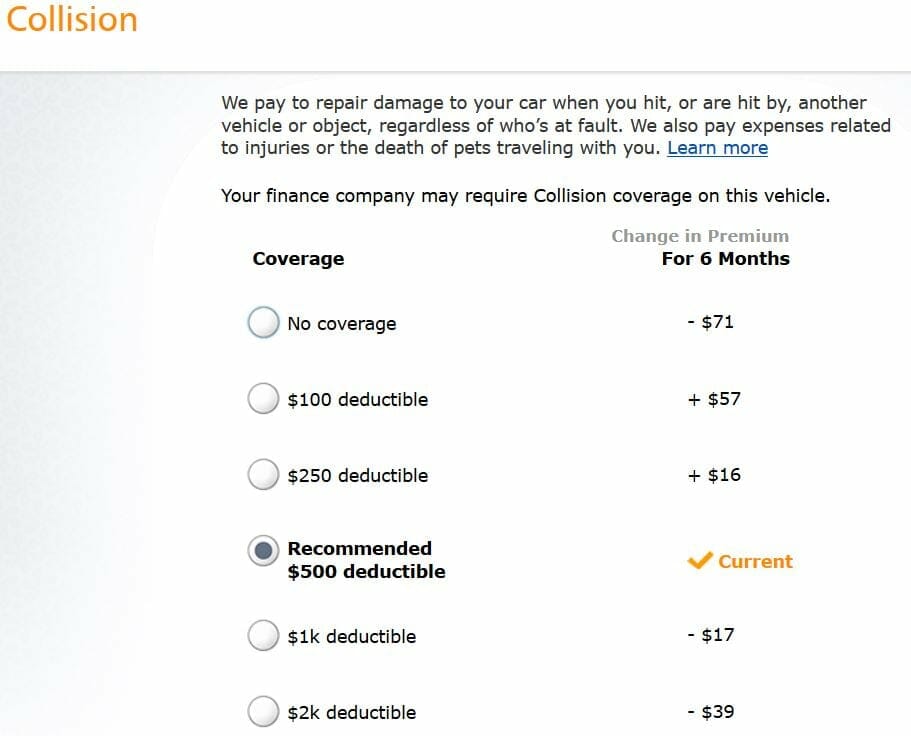

While increasing your insurance deductible will decrease your costs, there are various other impacts to think about for your auto insurance prices. Allow's take a look at all the aspects you must think about when choosing your car insurance policy deductible!

cheaper auto insurance auto cheapest auto insurance cheap insurance

cheaper auto insurance auto cheapest auto insurance cheap insurance

If you weren't required to have an insurance deductible, you might practically have as several accidents as you wanted on the insurance coverage business's cent - car. Paying a deductible ensures you also have a stake in any type of cases you make. Deductibles usually only relate to damage to your very own residential property, like whens it comes to comprehensive and also accident automobile insurance coverage.

What is the relationship in between the insurance deductible and premium? Usually, a reduced insurance deductible methods greater monthly settlements. If you have a reduced insurance deductible, you have more insurance coverage from your insurer and you need to pay less out of pocket in the situation of a case - cheap. A higher deductible means a minimized price in your insurance premium.

vehicle insurance automobile cheapest risks

vehicle insurance automobile cheapest risks

A low insurance deductible of $500 means your insurance provider is covering you for $4,500. A higher deductible of $1,000 suggests your company would then be covering you for only $4,000. Given that a lower insurance deductible relates to more protection, you'll need to pay more in your regular monthly costs to cancel this increased insurance coverage.

All About How An Insurance Deductible Works

This was dependent upon the state, however, where Michigan just saved 4% for the deductible raise while Massachusetts conserved an average of 17% (vehicle). Some individuals make the blunder of picking the highest insurance deductible simply to save money on their costs. In the case of an event, however, having a high deductible could have severe economic repercussions.

If you have that money handy at any factor, it could be worth going with a greater insurance deductible. 2. What is the repayment? Do the math with your insurance representative. How a lot would certainly you minimize a lower premium if you had a higher insurance deductible? Would certainly you save money that would certainly relate to that insurance deductible in the instance of an occurrence? For instance, allows state that changing from a $500 to $1,000 deductible would save you 10% on your yearly costs.

Currently you have an enhanced deductible by $500, but you are conserving $80 per year. If you do not obtain into an accident in those 6 years, the enhanced insurance deductible was worth it.

If you have a good driving record, a higher deductible can operate in your favor. You'll save cash on the costs, which you might utilize towards your deductible when it comes to a claim (business insurance). A motorist who hasn't had a mishap in 20 years may not be frightened by the above example of the 6-year time period to make up the difference.

4. Just how danger averse are you? Eventually, a greater insurance deductible is a greater threat. The reduced your deductible, the a lot more coverage and also protection you have. Just how much are you and also your household ready to run the risk of? 5. What is the worth of your car? Pricey automobiles cost more to guarantee. In this instance, a high deductible could make feeling due to the fact that you would have greater savings on your costs.

Are you renting or financing your auto? Individuals that are leasing or funding their automobile tend to choose a lower insurance deductible. This offers much better coverage when it comes to a claim. This is necessary for people who do not have their automobile, because they are liable for returning the automobile in working problem regardless of whatwith or without the monetary assistance of insurance.

Facts About How Does Car Insurance Deductible Work? Revealed

Collision plans cover those costs if your lorry strikes a car or other cars and truck. If you do not enter a great deal of accidents, you can take the risk with a higher deductible. Nonetheless, to keep it easy, you might wish to hold the very same deductible for all types of coverage and automobiles.

If you could not manage to make your deductible tomorrow, you require a reduced insurance deductible. If you're an excellent vehicle driver with a high tolerance for threat, you can increase your deductible.

Myth # 1: Red autos are one of the most expensive to insure. A red auto won't cost you more than an eco-friendly, yellow, black, or blue vehicle. Insurance providers have an interest in the year, make, model, type of body, engine dimension, and age of your lorry. Myth # More help 2: My insurance will certainly cover me if my auto is taken, ruined, or damaged by hailstorm or fire.

Comprehensive insurance coverage spends for damage to your auto that is not the result of a car mishap. Misconception # 3: If my car is amounted to, my insurance policy will certainly pay off what I owe on my funding or lease. It will only pay you the real cash value of your auto, minus your insurance deductible, factoring in devaluation.

Misconception # 4: If somebody else drives my car as well as gets right into a crash, their vehicle insurance will cover them, not mine. In many states, the vehicle proprietor's insurance coverage should pay for problems triggered by a crash (vehicle insurance). Obtain acquainted with the legislations in your state before enabling one more person to drive your car.

Deductibles could be a standard component of vehicle insurance plans, however that does not suggest every person comprehends just how they work. As a matter of fact, lots of motorists aren't familiar with exactly how your deductible quantity influences just how much you spend for cars and truck insurance. If you desire one of the most economical auto insurance coverage, choosing a higher deductible is one way to maintain your month-to-month insurance policy settlements reduced and also remain covered, but it's not the very best choice for every single chauffeur.

5 Simple Techniques For Understanding Your Insurance Deductibles - Iii

Keep scrolling to find out exactly how auto insurance policy deductibles job and also exactly how to choose the ideal deductible quantity for you, plus just how adjusting your insurance deductible might assist you decrease your regular monthly automobile insurance coverage repayment (car). What is a cars and truck insurance deductible? An insurance deductible is a set quantity of cash that you must pay upfront and also out of pocket when submitting a protected claim prior to your insurance coverage starts to assist cover the remainder of the damages.

To learn more about cars and truck insurance policy deductibles or a cost-free quote on budget friendly insurance coverage, phone call 1-877-GO-DIRECT (1-877-463-4732) or come by a Direct area near you!.?.!! * Settlement strategies go through terms and problems and might not be offered in all places. Price might differ based on just how you acquire. Not all items, discount rates, or pay plans are available in all states.

A red vehicle won't cost you more than an environment-friendly, yellow, black, or blue automobile. Misconception # 2: My insurance coverage will cover me if my auto is swiped, ruined, or harmed by hailstorm or fire.

Comprehensive insurance coverage spends for damages to your auto that is not the outcome of a vehicle mishap (suvs). Misconception # 3: If my cars and truck is totaled, my insurance coverage will settle what I owe on my financing or lease. It will just pay you the real money value of your cars and truck, minus your insurance deductible, considering depreciation.

Misconception # 4: If another person drives my vehicle as well as enters into an accident, their car insurance policy will certainly cover them, not mine - risks. In many states, the car owner's insurance policy should spend for problems triggered by an accident. Get acquainted with the laws in your state before enabling an additional individual to drive your vehicle.

Deductibles may be a basic component of car insurance policies, however that doesn't suggest every person recognizes just how they work. Several chauffeurs aren't aware of how your deductible amount impacts just how much you pay for cars and truck insurance.

Some Ideas on What Is A Deductible? - Sonnet Insurance You Need To Know

auto liability auto insurance credit

auto liability auto insurance credit

Keep scrolling to find out how cars and truck insurance deductibles work as well as how to select the ideal deductible quantity for you, plus just how readjusting your insurance deductible can help you reduce your month-to-month vehicle insurance repayment - vehicle insurance. What is an automobile insurance deductible? A deductible is a set amount of cash that you must pay in advance and expense when filing a covered case prior to your insurance coverage begins to aid cover the remainder of the problems.

For additional information concerning auto insurance coverage deductibles or a free quote on cost effective coverage, call 1-877-GO-DIRECT (1-877-463-4732) or come by a Direct location near you! (insurers).?.!! * Layaway plan are subject to terms as well as conditions and also may not be readily available in all areas. Cost may differ based upon just how you get. Not all items, price cuts, or pay plans are readily available in all states.

A red cars and truck won't cost you more than an environment-friendly, yellow, black, or blue auto. Misconception # 2: My insurance coverage will cover me if my vehicle is stolen, vandalized, or damaged by hail or fire.

Comprehensive protection pays for damage to your automobile that is not the outcome of an automobile mishap. Misconception # 3: If my auto is amounted to, my insurance coverage will certainly pay off what I owe on my financing or lease. It will only pay you the actual cash money worth of your cars and truck, minus your deductible, factoring in devaluation.

Misconception # 4: If somebody else drives my vehicle as well as gets into a mishap, their vehicle insurance will certainly cover them, not mine - cheapest car insurance. In the majority of states, the cars and truck proprietor's insurance policy must pay for damages brought on by a mishap. Obtain knowledgeable about the legislations in your state prior to allowing another individual to drive your cars and truck.

Deductibles may be a standard part of car insurance coverage, yet that does not suggest everybody understands how they function. In fact, lots of chauffeurs aren't knowledgeable about just how your deductible quantity impacts just how much you pay for auto insurance coverage. If you desire the most affordable car insurance, selecting a higher insurance deductible is one way to keep your regular monthly insurance policy settlements low and also stay covered, but it's not the ideal alternative for every motorist.

Not known Details About Should I Have A $500 Or $1000 Auto Insurance Deductible

Maintain scrolling to find out how car insurance deductibles work and exactly how to pick the right deductible quantity for you, plus just how adjusting your insurance deductible could aid you reduce your monthly automobile insurance policy settlement - affordable. What is an automobile insurance coverage deductible? A deductible is a set quantity of money that you must pay upfront and expense when submitting a covered claim prior to your insurance policy starts to help cover the remainder of the damages.

!! * Settlement strategies are subject to terms and conditions as well as might not be offered in all places. Not all products, discounts, or pay plans are available in all states.